Rolled Equity

What it means and why sellers should consider doing it

Most people think that a business is sold when the business owner is ready to retire, that the purchase price will be paid in cash at closing, and the transition of the business ownership will fully happen on the day of closing. While this does happen, oftentimes a buyer wants to ensure they have aligned interests with the seller and asks the seller to retain some equity or re-invest alongside the buyer (“rolling” a portion of their proceeds) in the company post-closing. Some thoughts related to this ask are:

If a seller believes in the business long term, they will want some way to benefit from the continued upside/growth of the business

The seller often holds the majority of the customer, vendor, and employee relationships, so if they retain some equity in the new company, they will be incentivized to help transition the relationships to the new buyer

The seller could be selling because of something they know about the business or industry that the buyer is unaware of. Therefore, if the business owner retains some ownership, it is likelier they are selling for the right reasons

Along with the above reasons, any equity re-invested or retained is less equity the buyers need to bring to closing, making funding the transaction somewhat easier

Commonly, however, sellers don’t know how to properly value an equity re-investment in a sale transaction. Some of concerns that sellers often share:

They don’t know how the buyer will make decisions and if they will make the right ones

They don’t know if the buyer will cater to customers and handle pricing the same way

They don’t know what will happen with the employees, whether they will be kept or fired

Because of these factors and more, rolled equity is occasionally viewed by sellers as a negative to a proposed deal. Although, it can be argued that a reinvestment opportunity requires further research. Oftentimes the return on the equity reinvestment can be significant. While it is true that most sellers won’t know enough about the buyers plans post-closing, the data shows that more often than not businesses sold to another buyer will end up returning the re-invested capital plus a return to sellers.

Let’s look at the data:

Blackstone noted a 2020 survey in which 87% of LPs (investors) said that returns from Private Equity "either met or exceeded their expectations”¹

According to a 2021 Market Survey of Private Equity Investments conducted by Bain Capital, ~20% of deals on average from 2016-2020 resulted in a loss, which is defined as returning less than the initial invested capital back to investors. That means that ~80% of deals on average from 2016-2020 returned the initial capital back to investors with some sort of return on capital²

The average multiple of invested capital for deals from 2015-2019 was 2.19x according to the Bain Capital survey. Meaning if you had invested $1 in a private equity fund you would have received $2.19 in return. In other words, the average private equity fund is more than doubling investors’ money³

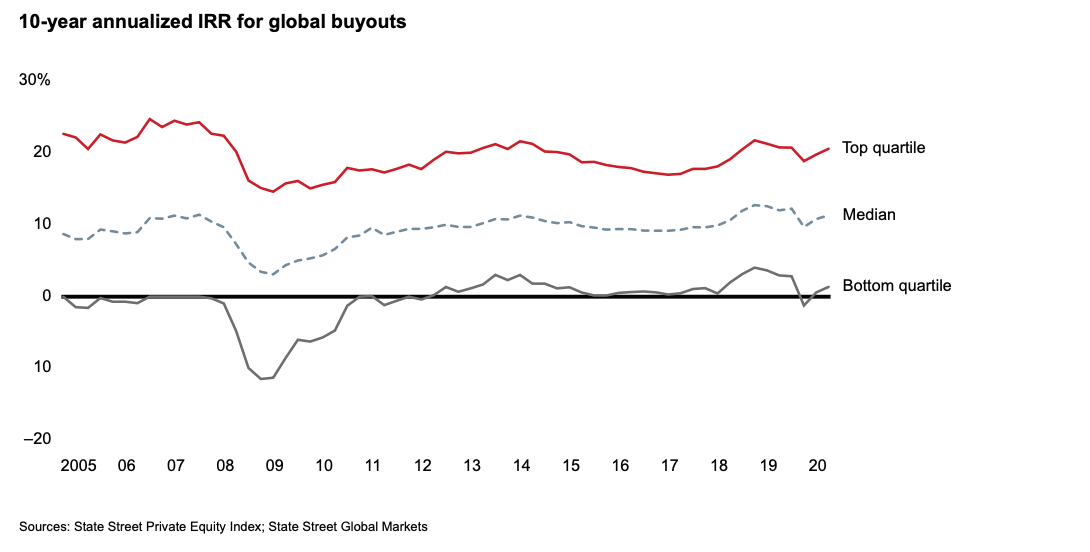

In the chart below you can see the actual performance of the top 25% of all private equity funds hovering around 20% IRR, the median around 10%, and the bottom 25% averaging a very small return but at least largely returning capital back to investors, other than in the Great Recession⁴

Outside of the data showing that re-investing equity in a deal has a chance to yield a positive return, there are other reasons for reinvesting in the business which include the following:

How often will a seller be able to find an investment opportunity in an industry and with a company that they know better than the one they are selling?

Sellers oftentimes don’t need all the cash received at closing to live on and don’t have enough quality investments to invest all the cash they receive

While most sellers might initially prefer an all-cash deal to a deal that involves re-investing equity in the transaction, there may be times where the seller should consider re-investing equity in the company. Since many private equity buyers have a track record of generating positive returns, and most sellers know more about their own businesses than they will about any other investment they could make, putting part of the purchase price back in as an equity investment might yield a second, larger, bite of the proverbial apple.

¹ https://pitchbook.com/news/articles/pe-stocks-lps-arent-turning-away

² https://www.bain.com/insights/topics/global-private-equity-report/ - 2021 Global Private Equity Report Page 7

³ https://www.bain.com/insights/topics/global-private-equity-report/ - 2021 Global Private Equity Report Page 24

⁴ https://www.bain.com/insights/topics/global-private-equity-report/ - 2021 Global Private Equity Report Page 22

For qualified institutional purchasers only. This document does not constitute an offer to sell or a solicitation of an offer to any asset or security.