PRIVATE WEALTH

A More Intentional Approach to

Lasting Wealth

Infinity Private Wealth was created for successful families and business owners who want more than traditional investment advice. We bring together investment management, estate planning, tax strategy, and liquidity planning into one integrated approach — ensuring every decision works in harmony to grow, protect, and preserve your wealth across generations.

An Integrated Approach, Purposefully Built

Infinity Private Wealth was founded to give successful families and business owners a more intentional alternative—one where investment management, estate planning, and liquidity strategies work in concert to build lasting, multi-generational wealth.

Infinity Private Wealth is an independent, fee-only wealth management firm providing highly personalized advisory services to high-net-worth and ultra-high-net-worth individuals and families. Our independence allows us to deliver objective guidance, free from product incentives or conflicts of interest.

OUR PHILOSOPHY & VALUES

Core Principles That Shape Our Investment Philosophy

At Infinity Private Wealth, we believe lasting wealth is the result of prudence, perspective, and stewardship. Many of our clients have already created wealth through their own enterprises. Our role is to help preserve and thoughtfully grow what they’ve built—ensuring it continues to serve their families, their legacy, and their broader purpose.

Prudence

Perspective

Stewardship

WHAT WE DO

Comprehensive Wealth Advisory

We provide comprehensive advisory services designed to simplify complexity, align decisions across disciplines, and help ensure your wealth supports both today and future generations.

-

Comprehensive Cash Flow Modeling: Project income and expenses as well as investment inflows or outflows, ensuring lifestyle sustainability.

Liquidity Management: Structure funding buckets that ensure sufficient short-term reserves available to fund near-term goals.

Tax-efficient Funding Strategies: Strategically coordinate withdrawals and distributions from taxable or qualified accounts to minimize tax drag.

-

Personalized Investment Policy Design: Establish customized Investment Policy that aligns strategy with goals, time horizon and risk tolerance.

Thoughtful Diversification: Utilize unbiased, open-architecture investment platform to develop thoughtfully diversified asset allocation plan.

Active Management: Ongoing monitoring and rebalancing, managing risk and capitalizing on market dislocations.

-

Estate Plan Integration: Coordinate with attorneys to structure and implement trusts, wills and beneficiary designations

Wealth Transfer: Develop and employ gifting strategies, using charitable giving strategies and other estate planning tools

Family Governance: Facilitate family meetings and education to encourage stewardship of wealth across generations.

-

Holistic Risk Analysis: Identify personal, business, market and legacy risks that could impact long-term wealth preservation.

Insurance Review: Evaluate gaps in insurance needs and coordinate with advisers to ensure proper protection.

Asset Protection: Coordinate with attorneys to advise on legal entity use, asset titling and trust strategies to limit creditor/litigation exposure.

-

Philanthropic Plan Design: Align charitable intent with tax-efficient giving vehicles such as DAFs, CRT/CLTs, or private foundations.

Impact Planning: Integrate and communicate philanthropic goals into family mission and estate planning objectives.

Tax Optimization: Facilitate timing and type of charitable gifts, such as appreciate assets or planned giving to maximize tax-efficiency.

-

Succession and Exit Planning: Educate and advise on transition options.

Valuation and Capital Structure Guidance: Evaluate business value, understand liquidity options and financing strategies.

Investment Bank Coordination: Work with investment banking team to ensure alignment between business and personal wealth objectives.

OUR LEADERSHIP

Leadership Behind the Strategy

Brad Wallace, CFA, CIPM

Chief Investment Officer

As Chief Investment Officer of Infinity Private Wealth, Brad leads the firm’s investment strategy, advisory platform, and client relationships. He brings deep experience advising high-net-worth families and business owners through complex planning decisions, including liquidity events and multi-generational wealth strategies.

Prior to co-founding Infinity Private Wealth, Brad served as Chief Investment Officer of a $700M+ wealth management division of a nationally chartered bank. His career includes senior roles at JPMorgan Private Bank, MidFirst Private Wealth, and Morgan Stanley.

Brad holds the CFA charter, the CIPM designation, and completed Columbia Business School’s Chief Investment Officer program. An Oklahoma native, he lives in Norman with his wife Emi and their two sons.

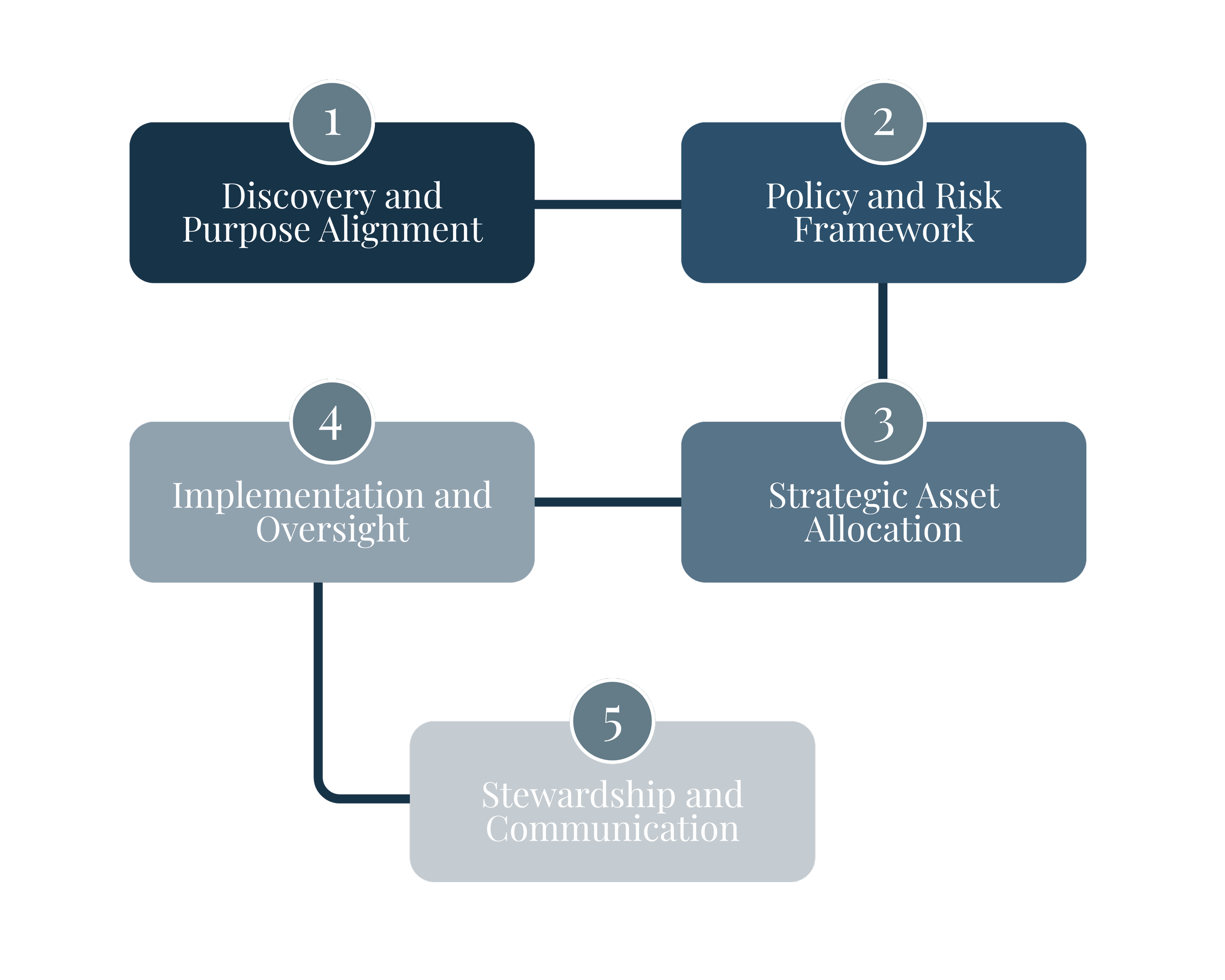

OUR PROCESS

A Disciplined, Evidence-Based Process

Our investment process is structured, objective, and intentionally designed to remove emotion from decision-making. Each portfolio is a customized reflection of purpose and priorities—not a reaction to market noise.

-

We begin by understanding the story behind the wealth — your ambitions, values, liquidity needs, family objectives, and philanthropic intent. This ensures every portfolio is anchored to purpose.

-

Together, we craft a formal Investment Policy Statement (IPS) that defines allocation targets, risk parameters, and decision-making rules. This document provides clarity and discipline across market environments.

-

We construct globally diversified portfolios built on long-term capital market assumptions and empirical data. Every allocation is designed with a risk-first mindset, ensuring resilience before return.

-

Portfolios are implemented with precision and monitored continuously against objectives, risk parameters, and changing client circumstances. Rebalancing is disciplined and opportunistic — never driven by noise or fear.

-

We see our role as long-term stewards of capital — accountable for both performance and peace of mind. Through clear communication and collaboration with your tax, legal, and estate professionals, we ensure your plan remains aligned with life’s evolving chapters.

Let’s Discuss the Next Chapter of Your Business

Whether you’re actively planning an ownership transition or just starting to explore your options, our team is here to help.

-

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Infinity Private Wealth LLC and our editorial staff. The information contained in this material has been derived from sources believed to be reliable, but is not guaranteed as to accuracy and completeness and does not purport to be a complete analysis of the materials discussed. All information and ideas should be discussed in detail with your individual adviser prior to implementation. Advisory services are offered by Infinity Private Wealth LLC a Registered Investment Adviser registered with the State of Oklahoma.

The presence of this website shall in no way be construed or interpreted as a solicitation to sell or offer to sell advisory services to any residents of any State other than where legally permitted. All written content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for your specific financial decisions.

Images and photographs are included for the sole purpose of visually enhancing the website. They should not be construed as an endorsement or testimonial from any of the persons in the photograph.

The inclusion of any link is not an endorsement of any products or services by Infinity Private Wealth LLC. All links have been provided only as a convenience. These include links to websites operated by other government agencies, nonprofit organizations and private businesses. When you use one of these links, you are no longer on this site and this Privacy Notice will not apply. When you link to another website, you are subject to the privacy of that new site.

When you follow a link to one of these sites neither Infinity Private Wealth LLC, nor any agency, officer, or employee of Infinity Private Wealth LLC, warrants the accuracy, reliability or timeliness of any information published by these external sites, nor endorses any content, viewpoints, products, or services linked from these systems, and cannot be held liable for any losses caused by reliance on the accuracy, reliability or timeliness of their information. Portions of such information may be incorrect or not current. Any person or entity that relies on any information obtained from these systems does so at her or his own risk.